Blis, a trusted location-powered advertising and analytics company, partners globally with IRI to help marketers create a holistic understanding of consumer behaviours and boost campaign efficacy through store visits and purchase data.

COVID-19 restrictions on movements are gradually lifting, leaving most countries to face economic recessions. While some are predicting a V shaped recovery, Blis and IRi have looked at patterns of consumer behaviour to indicate what is likely to happen next – with the probability that far from being smooth, our rehabilitation will likely resemble wiggling up a bumpy slide.

For FMCG retailers and brands the fundamentals of their operations are likely to have altered, making it even more essential to understand and connect with their customers using a personalised approach. The need for assurance on safety measures and more people working from home has opened up new challenges and opportunities (e.g. social distancing measures in store and an increase in people experimenting with cooking and baking at home, requiring a broader range of ingredients). Using these insights will help brands prepare for changes, both short-term and longer lasting shifts in shopper behaviour.

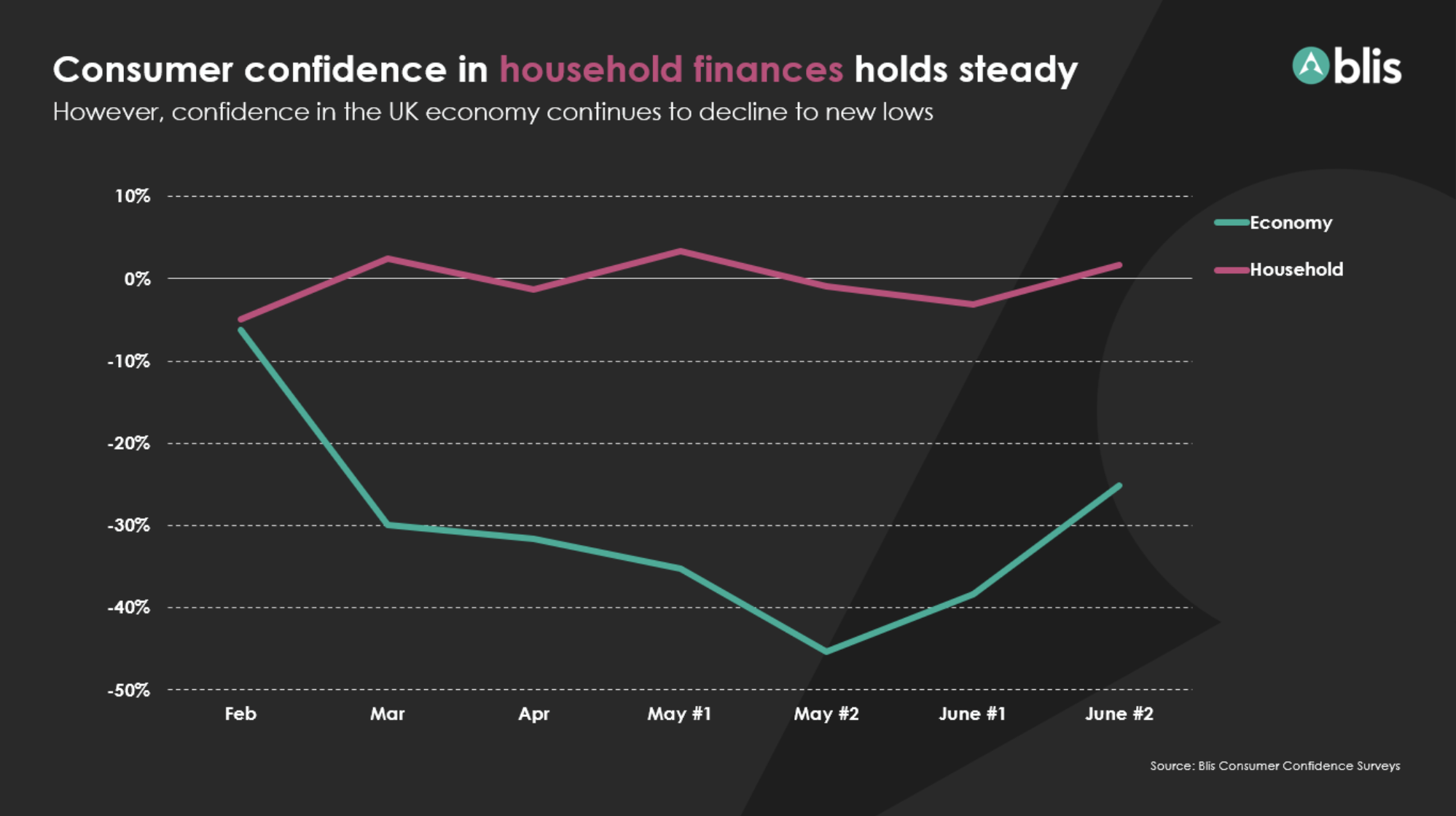

Financial confidence is stable, for now

Over the course of the past five months Blis has been running surveys, focusing on consumer confidence in their personal financial situation and that of the UK economy as a whole. Throughout this period we’ve seen confidence in household finances remain steady, while confidence in the UK economy declines to new lows. The positive outlook regarding personal finances even increases at points, whilst the economic outlook plunges highlighting that consumers are focused on the near term for stability.

This stark contrast between the two is perhaps indicative of the financial aid the government is providing to the almost 9 million employees who have been furloughed. Despite concerns for the economy, brands should be heartened to see consumers are feeling confident about their own personal finances as an indicator of intent to spend. However, when support schemes are removed we may see consumer confidence dip and the personal and economic outlook align more closely once again.

What has emerged, however, is a more cautious and value-conscious consumer. A recent IRI white paper, Advancing in the Next Normal, has shown that during the pandemic, branded FMCG goods increased share by four percentage points – with this increase largely driven by availability. With stock levels returning to normal, and financial uncertainty continuing, brands will have to work hard to maintain share, as previous recessions have shown that consumers are likely to reach for private label products to help manage tightened budgets.

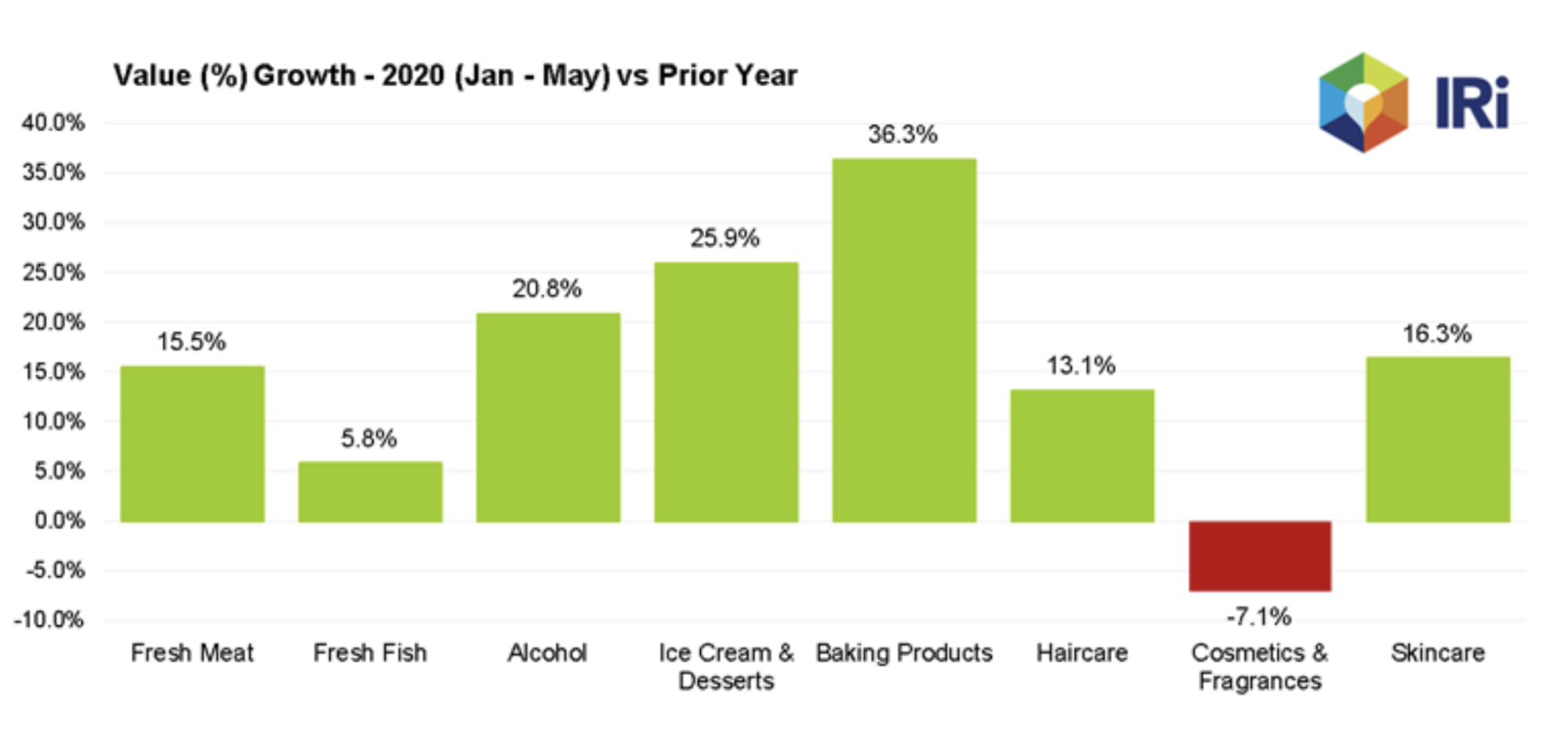

Source: IRI Retailer Advantage | Total Market | Food & Non Food | Data – January – May 2020 | Value % Growth

- Recreating the experience of dining out at home: Throughout this period, shoppers have been spending their budgets on alcohol, fresh meat and fish, ice cream and desserts. This trend may continue as restrictions on the hospitality sector are likely to have an impact even now the sector has re-opened and offers an opportunity to brands for product innovation or new partnerships to help meet this need.

- The comfort of home baking: With more time on their hands consumers turned to home baking with products in this category experiencing sustained growth. Eggs and flour were heavily impacted by the stockpiling behaviour seen in mid-March and home baking, as a category, has remained popular since.

- Personal care products impacted by decreased social contact: Sales of cosmetics and fragrances have declined compared to last year. Skincare, however, has seen growth, with new opportunities opening up as people rely less on make-up products. Green shoots are arising in the personal care category as a whole in recent weeks, suggesting that as social restrictions ease, it may become more prevalent once again.

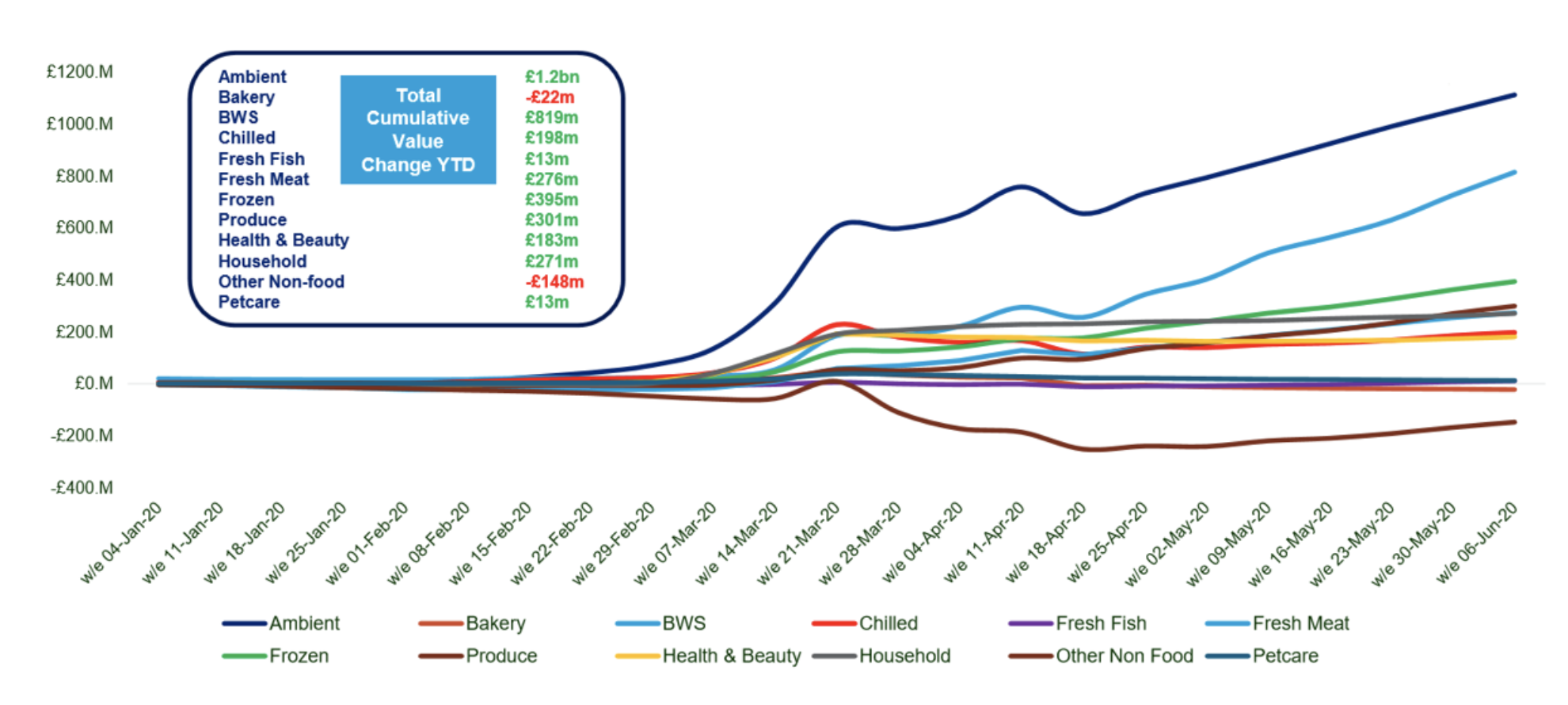

IRI Retailer Advantage | Total Market | Food & Non Food | Data – w/e 06/06/2020 | Value

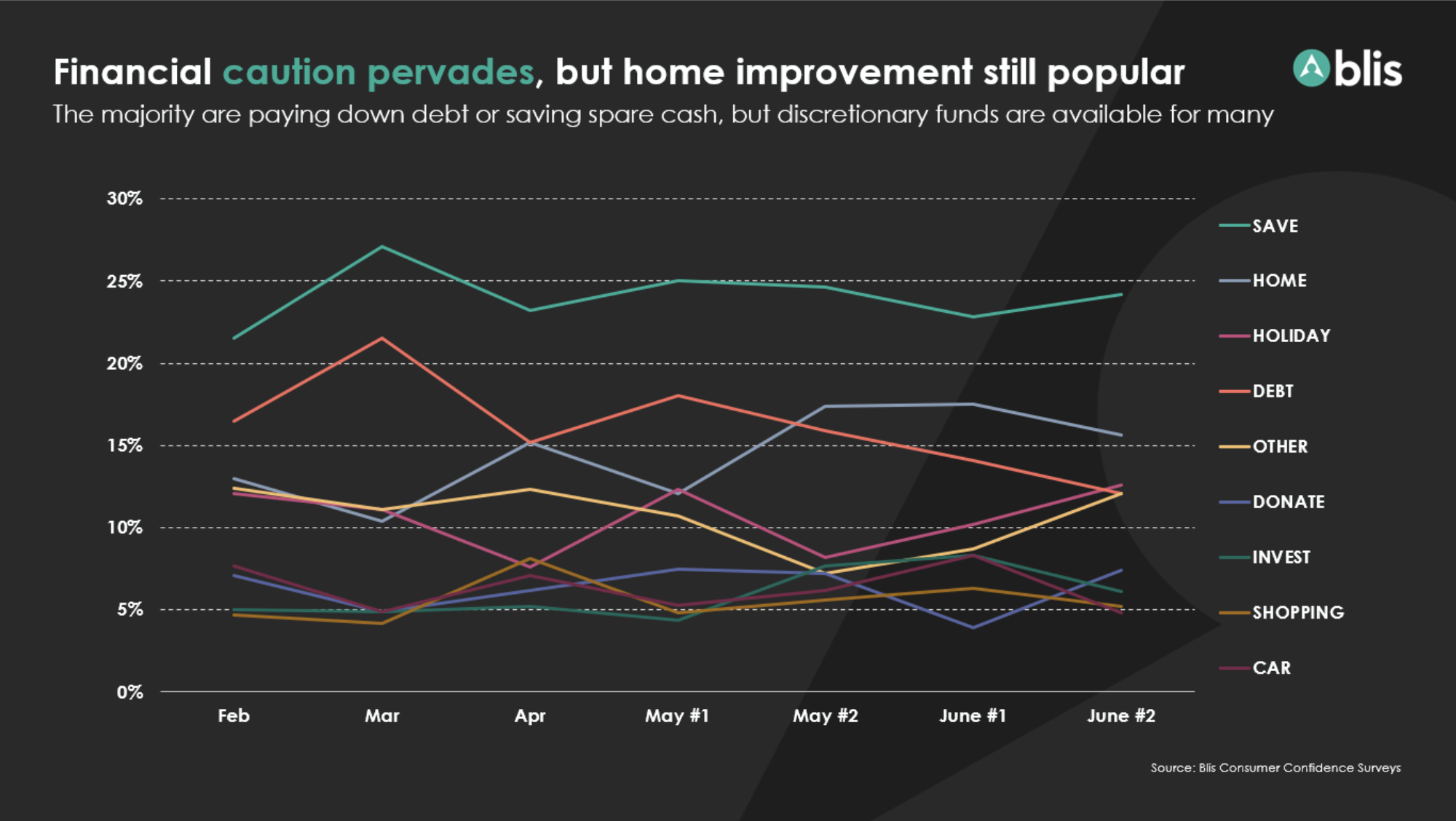

How to address the challenge of a more financially cautious consumer

When asked where they would spend £1000, the majority of respondents in the Blis consumer study opted to save or pay off debt. With this more long-term spending approach brands should focus on reassuring shoppers of the value their products offer and emphasise the convenience they provide.

However, it’s not all doom and gloom as the Home & DIY sector remained resilient throughout, seeing growth from early May. And, despite being lower on the chart, shopping too has remained consistent throughout the period. With non-essential retail stores opening recently the next wave of this study may show some interesting shifts, hopefully buoying up a sector that was down a record 18% month-on-month.

Using data from other markets and across multiple sectors Blis can model a predictive path for retailers across the UK. A significant pattern emerging is that of the “dead cat bounce”, a temporary recovery after substantial decline. This short term seasonality can be expected across most sectors, as people rush to return to treat themselves after lockdown.

This pattern is also reflected in the frequency of visits and purchases that consumers make when they do visit the store. IRI data shows that factors such as adhering to lockdown measures and concerns about the in-store environment have meant that many shoppers have returned to one big weekly shop in previous weeks. While transaction numbers have been down by almost 50%, the average number of basket items has increased by 65% during lockdown and spend per trip metrics increased too.

Key takeaways: a cautious return to recovery

While many FMCG brands and retailers are moving from stability to recovery, this isn’t the case for all businesses. Below are some predictions for the remainder of 2020 and moving into 2021:

- We won’t see a V-shaped recovery: While we are currently seeing an uptick, brands should prepare for the trajectory to be interrupted more than once as we get close to pre-COVID levels. Understanding the concerns of your customers and how they behaved during the initial lockdown will help brands plan for future restrictions, should they arise.

- Cautious confidence: For many, survival mode is over and people are keen to return to a routine. However, the financial stability of the UK economy is cause for concern and is impeding a spending surge. Brands should focus on understanding their consumer, making sure they offer a clear value proposition and position their products as longer lasting and better value for money.

- Lockdown habits may pervade (at least for now): Throughout the lockdown period consumers adapted their behaviour out of necessity. As the hospitality industry cautiously opens the doors this month, a nervous public may continue to convene in smaller private spaces and spend their money ‘premiumising’ treats for the home e.g. more expensive wines and luxury ingredients. Understanding which habits are pervading provides an opportunity for brands to meet those needs.

Financial uncertainty and interruptions to our daily lives are likely to continue for some time. For advertisers, accurate data and meaningful insights into consumer behaviour will be invaluable for identifying and adapting to new opportunities as they arise. Agility is key in periods of instability, both in terms of operations and communications. As we look ahead to the remainder of 2020 and into 2021 ensuring a strong measurement framework is in place to gather learnings and quickly optimise media and creative will be essential for brands.

Learn more about how Blis‘ planning, measurement and activation offerings and IRi’s data analysis and market research can help personalise your marketing and strengthen your business.