American anthropologist Margaret Mead shared the wisdom that, “What people say, what people do and what people say they do are entirely different things.” We humans are fickle beings and put forward an ideal version of ourselves. But, despite people often saying one thing and actually doing another there is a lot to be learned from this discrepancy. For brands, there’s huge value in understanding the aspirations of their consumers, as well as their actions.

At Blis, we analyse vast quantities of movement data to identify trends. Since COVID-19 was labeled a pandemic we have been analysing this data and distilling it for key takeouts in The changing behaviour series, helping clients adapt and react quickly. This information was telling us what consumers do, but not what they say they do. We know that foot traffic reflects consumer confidence and so, we launched the Blis consumer confidence pulse. It’s an interactive tracker that gives us a read on consumer sentiment which we can use to supplement our consumer movement data and retail foot traffic to get a more holistic view of the current state of play.

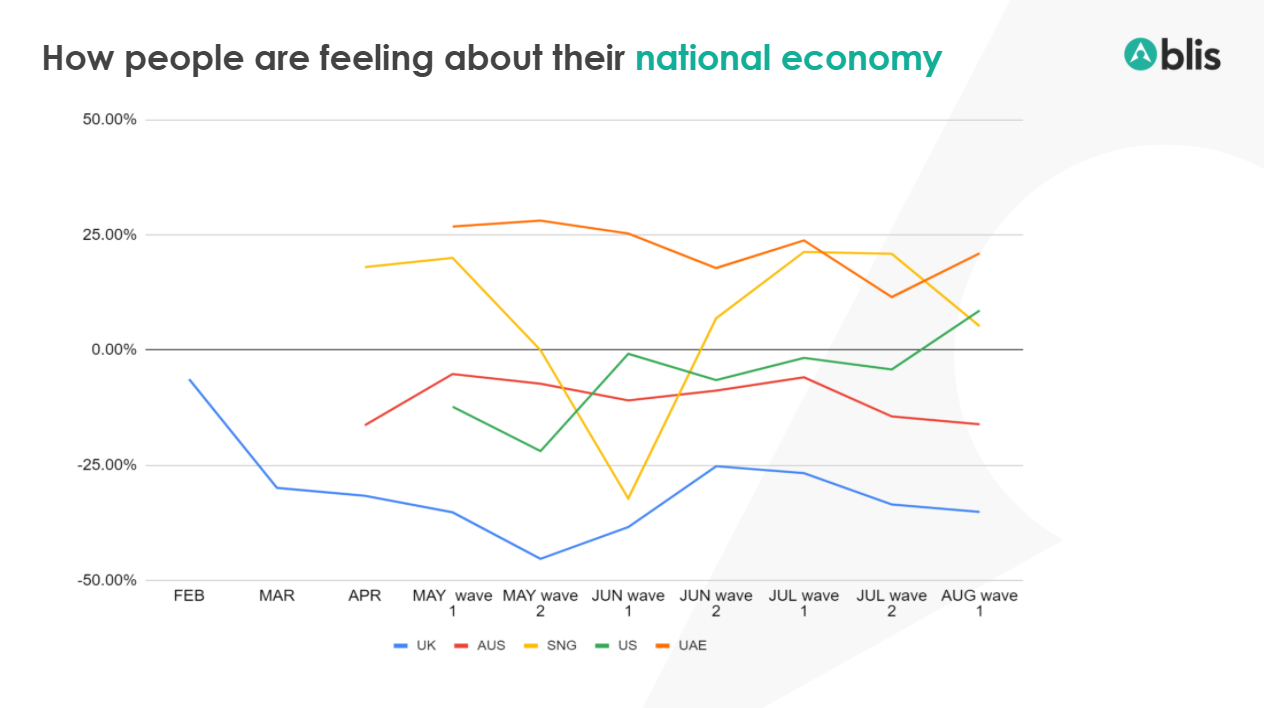

When we examine the perceptions of individuals towards their national economy we see quite varying viewpoints across markets that have remained surprisingly robust. Across the world, economies have been drastically destabilised. Unemployment figures are rising alongside COVID case numbers in many parts of the world and governments are funding policies to support their citizens health and financial wellbeing.

Those in the UK have a much more pessimistic view, with net sentiment reaching its lowest point in late May, as the narrative in the media shifted towards the impending recession. For Singaporeans the lowest outlook occured in early June, following announcements from the government about a long road to recovery. Australians and those in the UAE have remained consistent in their view, while Americans have seen a gradual incline, driven in part by a shift from a negative to a more neutral outlook, potentially pending news about unemployment support.

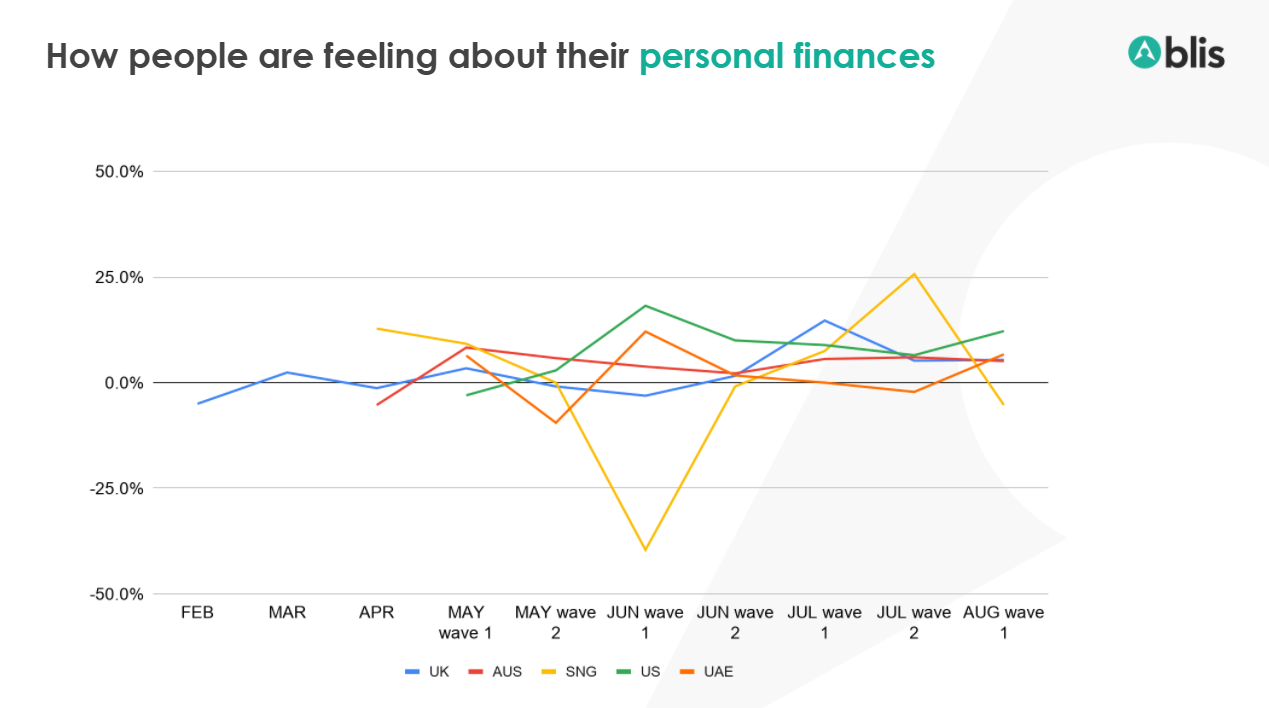

When it comes to personal finances we see a significantly more positive outlook across the board. Singaporean’s confidence plummeted in early June but quickly recovered. The UK and US have employment schemes and incentives in place, which buoyed sentiment around household finances. Once these schemes finish this picture may change, however, as more countries are impacted by higher levels of unemployment.

When comparing these trends we see vast differences in sentiment towards the economy and personal finances. This is important to note. And it is perhaps most marked in the UK, where overall negative sentiment towards the UK economy has remained around the 50% mark since March while positive sentiment has fluctuated, rarely rising above 20%. The view is much more evenly spread when asked about household financials, with more people indicating overall positive sentiment than negative. The apparent absence of connection between the home and the wider economy emphasises the importance of addressing the immediate needs of the consumer.

What we’ve consistently seen through our data, and it appears most evidently in the responses to question 3 on the survey (If you had $1,000 to spend right now, what would you spend it on?), is that the majority of people intend on behaving very sensibly and cautiously. Blis’ foot traffic data also reinforces this trend, showing many sectors are still below 50% of pre-COVID visitors. The bulk of respondents to the survey, regardless of the market, have said they will prioritise saving or paying off debt.

However, alongside this financial caution, each market is demonstrating high preferences for either home improvement or cars. Using these insights and modelling against targeted audience groups will help brands reach the right audience when they are most open to engaging.

To dig in deeper to the data, check out the trackers for the UK, US, UAE, Australia and Singapore here