Living through a global pandemic for close to a year means people have gotten somewhat used to changing rules and curve charts. It also means that we have vast amounts of data and increasingly useful hindsight to help make sense of behaviour patterns of both the virus and consumers. In this post from ‘The changing behaviour series’ we look at what Lockdown 2.0 means for retailers in the UK.

In March, consumers and businesses were in shock. Panic and fear guided decision making as almost everyone was uncertain of the “right” approach. To mask, and potentially take supply from essential workers, or not to mask and risk exposing yourself to a virus ravaging countries around the world. This led to paralysis in consumer behaviour.

This time round we have a schedule, confirmed furlough supports, masks, The Great British Bake-off and Strictly Come Dancing. British consumers weathered the first storm and – for better (resilience) or worse (rebellion) – are battle hardened to face the current one. They adapted retail behaviours to cope with Lockdown 1.0, so are now better equipped, as are many more retailers, to navigate lockdown for the next four weeks.

These adaptations included greater market penetration for grocery – and increasingly the ‘non-essential’ – deliveries, as well as social distancing and masks for in-store visits. For those consumers who will visit brick and mortar stores upon their reopening, it’s likely to be premeditated and deliberate with a higher intent to purchase.

There is no escaping the fact that Q4 will be different – not to mention difficult – this year: greater consumer caution (from both a health and financial perspective), cold, wet weather and the sad but simple truth that it will be a rather diminished seasonal experience (socially distanced ‘Santa’ and the absence of a Christmas party season) may give shoppers fewer reasons to visit department stores, shopping malls and the humble high street.

And yet, there is some hope that it won’t be all doom and gloom – both supply (retailer adaptations) and demand (consumer appetite) have proved resilient, are in better shape this time round and they’re mutually driven to make it work.

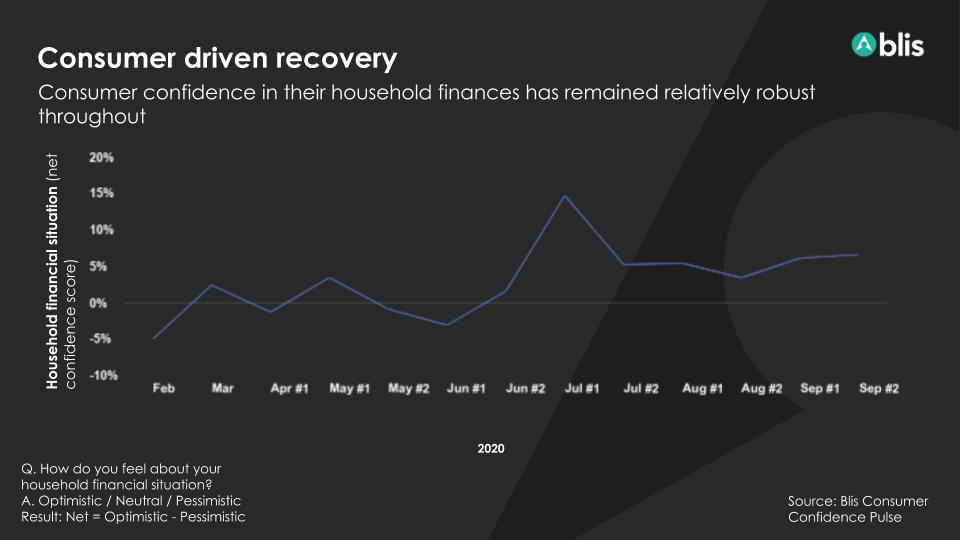

We’ve been running a sentiment tracker since before the first lockdown to monitor consumer confidence in their finances. Throughout Q3, when non-essential retail reopened in the UK, more than 70% of respondents have consistently answered that they were either neutral or optimistic regarding their household financial situation.

This resilience in consumer confidence suggests the barriers for retail – governmentally imposed closures aside – are due more to caution (e.g., inclination to save and to rationalise purchases) than to a universal inability or disinclination to spend.

Consumer demand was artificially stalled and, as soon as the opportunity to re-engage with retail returned, so did consumers. When non-essential retail stores reopened on June 15th, they were back at 95% of pre-lockdown sales by July and +2% by September.

Alongside this, online sales grew in importance during lockdown, reaching a high of 32.8% of all retail sales in April. As of September, they’ve settled at 26.1%. (source: ONS)

Looking ahead to when the lockdown lifts, we anticipate that there will still be fewer visitors making fewer visits than pre-COVID. But data shows us that sales are indexing higher in all categories than they were at the start of the year. Every visit, whether online or instore has become more valuable and consumer appetite remains undiminished.