In this post from The changing behaviour series we look at foot traffic to national quick service restaurant chains (QSRs) and pubs across the UK over the course of August to understand the impact of the government’s introduction of the Eat Out To Help Out Scheme (EOTHO). This scheme enabled diners to receive 50% off their bill on food and non alcoholic drinks consumed on site up to a maximum discount of £10 per person.

I am sure that many of you reading this – much like this author – will have embraced the opportunity provided by this scheme to indulge yourself at your favourite restaurants, QSRs and pubs throughout August. Therefore, it will come as no surprise that its introduction led to a surge in visitation for on-premise businesses.

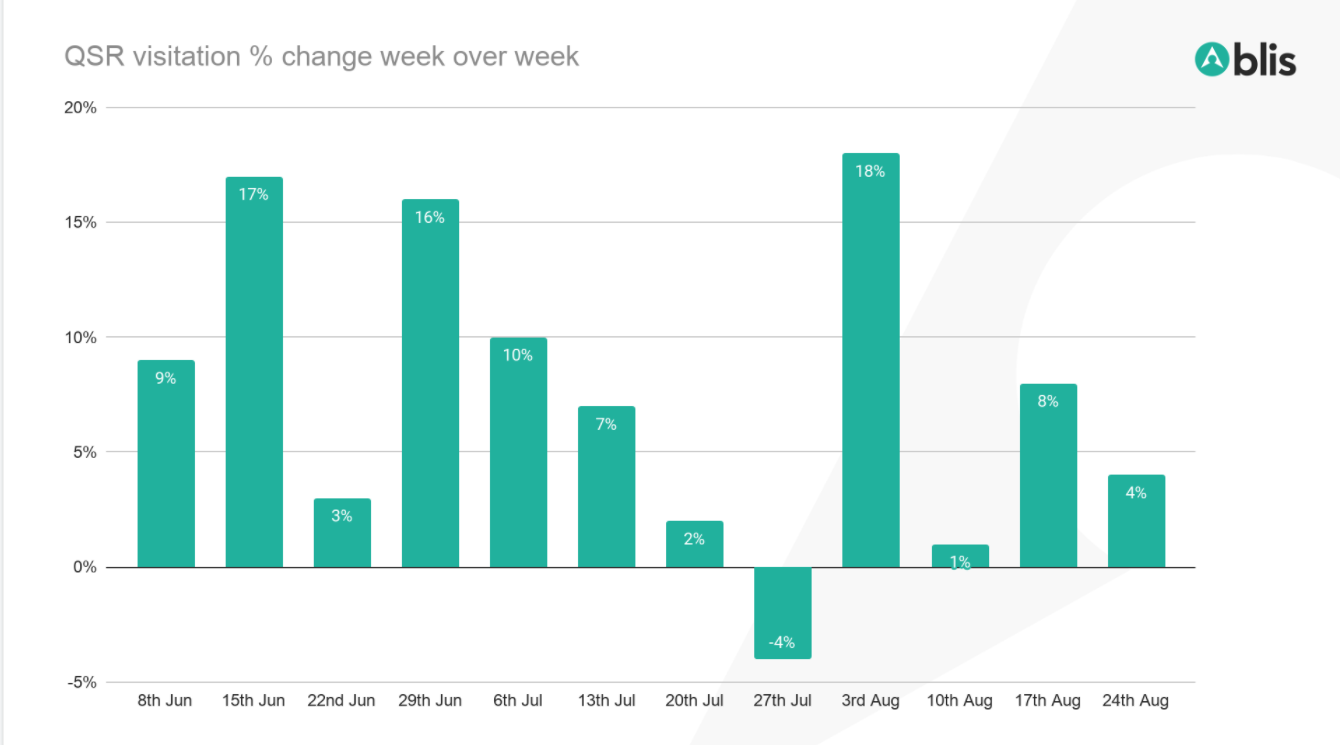

The week commencing August 3rd saw the strongest performance in 12 weeks as QSRs saw an increase in week over week visitation of +18%. This performance was particularly strong as it followed a decline during the previous week, the only one recorded since reopening. In anticipation of the scheme’s imminent introduction, it appears that consumers decided to postpone their visits. Taking a broader perspective it’s clear that shifts in government policy have repeatedly provided the rocket fuel for recovery with the three strongest weeks of growth in the last 12 weeks coinciding with the introduction of EOTHO (w/c 3rd August), the reopening of non essential retail (w/c 15th June), and the reopening of the pubs (w/c 29th June).

Whilst the government discount did not apply to alcoholic drinks, pubs around the country followed a very similar pattern and were galvanised by the scheme. It is clear that pubs were able to leverage their food options to drive punters through their doors, and this was particularly the case for the major chains. During the first week of the scheme’s introduction these chain pubs saw an increase in footfall of +15% week over week, the single largest increase since the pubs reopened in early July.

The number of visitors to QSRs and pubs remained consistent in the second week of the scheme. However, this was followed by strong single digit growth in the final two weeks for these venues. The impact of the scheme reached its apex in the final full week of the scheme which saw the two highest single days of footfall for August – Wednesday 26th and Monday 24th.

In comparison to these two standout days, the QSRs performance on bank holiday Monday was slightly more muted and may reflect the extra time that consumers had, making casual and fine dining restaurants more desirable outlets. QSR’s appear to have been much greater beneficiaries in previous weeks as a result of their ability to tap into a broader range of consumption occasions, from breakfast, lunch and dinner to ad hoc meal times. However, for those QSR chains with a heavier focus on dining in, such as Nandos, the bank holiday was more significant and it ranked as the 3rd most important day in August.

The biggest change in consumer behaviour that we observed in August was that Wednesday became the day of the highest visitation amongst QSR’s. The shift to midweek overtook the traditional peaks of Friday and Saturday and can be viewed as an apparent result of the scheme. Whilst Saturday remained the unrivalled leader for pubs, Wednesday narrowly overtook Friday as the 2nd biggest day in the week. Weekdays gained greater prominence for pub goers throughout the week but it is worth noting that early concerns that diners might replace their weekend visits with discounted weekday meals appears unfounded. Throughout this period we observed successive weeks of weekend growth for both QSRs and Pubs alike.

Mcdonalds was the QSR which emerged as the biggest winner in terms of gaining share. Its ubiquity across the country, ease of access and broad menu reminded people of the tried and tested staples; like its signature Big Mac. Whilst the challenge remains for restaurants to simply get consumers comfortable with eating out again, leveraging the core brand assets that diners have a connection to over new and exciting propositions could be key. The likes of Dominos and Greggs experienced the greatest losses in terms of share, as their overwhelming focus on takeaway undermined the benefits they might have seen from the scheme. It is worth clarifying that despite the latter two QSRs loss of share their footfall also increased through August buoyed by the continued trend of increasing public confidence leading more consumers to engage with the physical world.

With the scheme now wrapped up there are some key learnings that brands can use for leverage over the coming weeks and months.

- One of the key observations that we found throughout August was that the audiences during the EOTHO days became increasingly differentiated to visitors that came during weekends. The growth that we saw in both periods was due to an influx of new and unique consumers, rather than an increase in frequency, as consumers used the scheme to try a number of different outlets. This means that a QSR or pub’s audience is likely broader than in the past with a mix of loyal customers, competitor diners, passionate foodies, and opportunists.

These diners now have the experience of your brand fresh in their memory. It’s now essential to keep these relationships warm. By retargeting over the course of the next few months QSR and pubs can try to either secure this loyalty or earn a greater share of their spend than in the past. Given the increased promiscuity of consumers that we observed this is an opportunity for all brands so securing a greater share of voice will be the key. - Crucially, we saw a change in behaviour as consumers ate out in much greater numbers at the start of the week. We’ll continue to monitor this over the coming months to see whether this becomes a longer term consumer trend. With many employees now working from home, the flexibility of this new normal work-life routine, provides us with more personal time during the week and a platform for eating out more. Combined with the limited range of outlets, there is an opportunity for brands to try ingrain the ‘early week treat’ as an ongoing behaviour. For example, Deliveroo has launched a promotional campaign “Eat In To Help Out” that offers consumers a discount of £5 on £20 worth of spend. Similar initiatives can help to reinforce the behaviour we have seen throughout August. QSRs may also benefit from a trickle down effect as consumers want that early week indulgence without the fees associated with full service restaurants.