Over the past few months we’ve seen drastic shifts in consumer behaviour when it comes to shopping malls in the UAE. At this stage of the year Summer Sales are usually well under way and groups congregate in the cool interiors. Ahead of restrictions easing this coming weekend we followed up a previous analysis of shopping patterns in UAE malls.

For ‘The changing behaviour series’ we examined the trends in visitors to shopping malls in Dubai and Abu Dhabi. Malls across both cities are welcoming much less visitors through their doors as a result of restrictions and the fluctuating pattern of a spike and subsequent dip in visitors returning mirrors a trend we are seeing in other sectors and markets around the world.

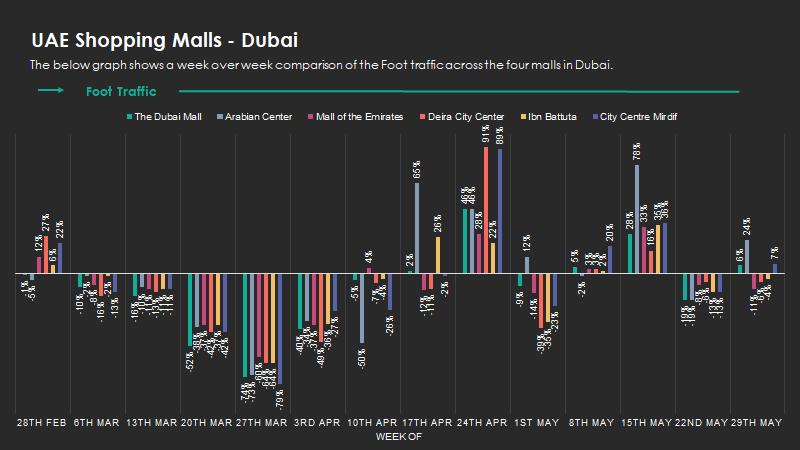

Taking a week on week view there’s been a variant return in foot traffic across 6 malls in Dubai. Following the news that residents no longer needed a permit to leave the home on 23rd April foot traffic to all malls grew considerably, with Deira City Centre and City Centre Mirdif seeing a spike in visitors (91% and 89% respective increases week on week). However, this growth was offset by a decline the following week and for the subsequent peak in mid-May there was a similar successive dip in visitors.

Malls in Abu Dhabi observed similar patterns of increased foot traffic with the Wahada Mall witnessing a 42% increase, following several weeks of decline. This growth in foot traffic to the mall continued the following week but the pattern reversed at the end of May. Restrictions in the Emirate began to ease mid-month with malls permitted to hold 40% of store capacity and all experienced the flux in traffic following the initial surge.

Taking a closer look at the data we can see shifts in consumer behaviour when visiting the main malls in each city.

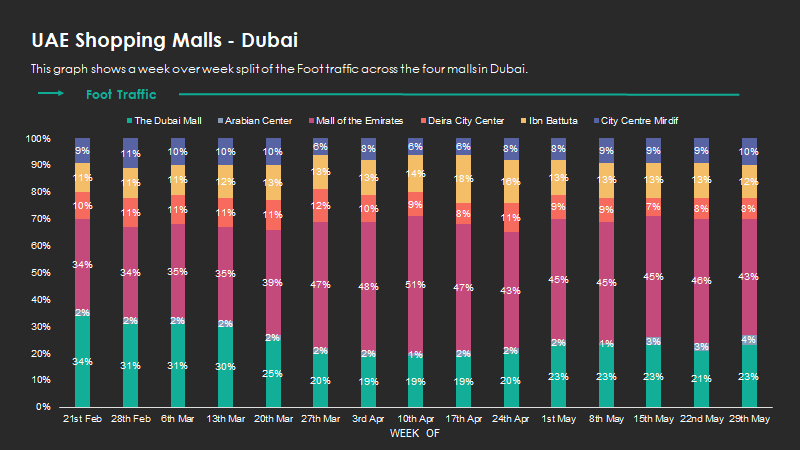

In Dubai, the Mall of the Emirates holds 43% of the market share when compared with its competitors, growing from 34% at the beginning of February, while the Dubai Mall’s share has declined from 34% to 23%. Both premises are heavily impacted by the lack of tourists who normally crowd the halls but with restrictions on leisure activities lifted, the Mall of the Emirates has used the opportunity to safely entice visitors back to the indoor ski slopes, restaurants and cinemas, with enhanced safety measures in place.

Shopping malls in Abu Dhabi have a more evenly distributed share of the market. The Marina Mall has seen the biggest shift in share, growing from 15% in February to 19% in May. YAS Mall conversely, witnessed a drop from 36% to 31% over the same time period, dipping to half (18%) in early April when the Galleria Mall experienced a spike in foot traffic.

As those older than 60 and younger than 12 are permitted to enter malls again, malls across the Emirates have the opportunity to grow market share by demonstrating the safety measures they are putting in place.

Early foot traffic indicators are pointing to the emergence of a more recessionary-minded consumer and the desire to gravitate towards trusted retailers and brands may be countered with price sensitivity. This is something marketers should closely monitor, while doubling down on brand equity to outweigh cost considerations and delay the need for discounting.